Sell Low, Buy Higher?

April 8, 2013

The monthly interfund transfer stats for January were just posted on Friday, and based on the numbers, TSP participants appear to have regained their confidence in the stock markets and the TSP stock funds big-time.

In January this year, TSP participants transferred a record amount out of the G and F Funds, while they transferred a record amount into the C and S Funds since the beginning of 2007 (when the current transfer data begins). The I fund experienced a similarly large influx of investments in January, but the amount did not quite reach record levels, since the total amount transferred into the fund appeared similar to transfers during brief periods of investor euphoria in the spring and fall of 2007, and again in mid-2009.

In all, TSP participants transferred over $3.75 billion out of the G Fund in January and over $1.15 billion out of the F Fund. They transferred over $1.18 billion into the C Fund, over $1.52 billion into the S Fund, and $693 million into the I Fund. The record fund transfers indicate that TSP participants regained their confidence in the stock markets after the election and after the deal to postpone sequestration and the debt ceiling (and the debt ceiling is now scheduled to be reached in May, just over a month from now).

Interestingly, the activity in January – at a time when stock markets were close to their all-time highs – contrasts sharply with activity during the depth of the market decline in 2008-2009, when TSP participants shifted significant amounts from the stock funds during the all-time market lows to the G Fund, and to a lesser extent to the F Fund.

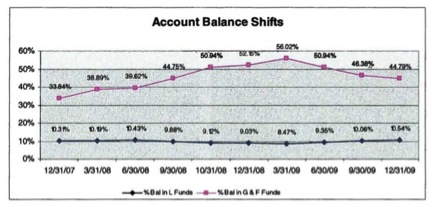

According to the historical figures and, separately, a study titled “Update on Participant Investment Behavior During the 2008 Financial Crisis” – completed in early 2010 – TSP participants moved significant balances out of the equity funds and into the G and F Funds in 2008-9. Indeed, investors transferred over $4 billion to the G Fund in each of two months in 2008, and over $2 billion in February 2009 and close to that amount in the following month when the equity markets bottomed out. The chart below from the “Participant Investment Behavior” study illustrates the shift in funds during that time:

The change in account balance percentages was both a function of TSP participants shifting from the stock funds to the bond funds and a function of the decline in the stock funds themselves, as their falling values meant their percentage of total TSP holdings declined as a natural result.

TSP participants’ aggregate behavior in 2008 and early 2009, together with the most recent interfund transfer activity, appear to indicate that a not-insignificant number of participants are “selling low, buying higher.”

Had investors shifted money from the G Fund to the C, S, and I Funds at the end of 2008 and into February and March 2009, they would have more than doubled their money since then. And their investments would have grown even more had they invested their biweekly contributions into those funds at that time also (as discussed in-depth in TSP Investing Strategies).

Could the current activity be a contrarian indicator? I do not know, and as the situation in 2008-2009 indicated, these situations can take many months to develop. But I’m keeping some powder dry to implement Strategy IV, just in case.

Related topics: investing-styles c-fund f-fund g-fund s-fund i-fund l-funds